Every year, the Internal Revenue Service announces the contribution limits for retirement plans, including 401(k), 403(b) and 457(b) plans. As you review your finances, it is important to consider your retirement plan contributions, too.

Contribution limits for 2022

In 2022, the total amount you may contribute as a salary deferral is the lesser of 100% of compensation or $20,500. If you are age 50 or older, you may be able to make an additional catch-up contribution of up to $6,500. (403(b) and 457(b) plans may offer additional catch-up contributions.) Check with your employer for specifics. All limits are subject to change in future years.

Save taxes now or later?

What if your retirement plan offers a choice of pretax and Roth contributions? If you decide to make pretax and Roth contributions to your retirement, then the annual limit above applies to the combined total. Below are other considerations when choosing between these types of contribution:

• Pretax contributions can help you save taxes now

With pretax contributions, your take-home pay is reduced by less than your total contribution and you benefit from an immediate tax reduction.

• Roth contributions can help you save taxes later

With Roth contributions, your take-home pay is reduced by your contribution amount since these are made with after-tax dollars. However, withdrawals of earnings on Roth contributions are not subject to income taxes if you are at least age 59 1⁄2 and have held the account for 5 years or more. Additional rules may apply. Roth contributions could be valuable if you expect your tax rate to be the same or higher at retirement than it is now, you want your beneficiaries to receive tax-free distributions, or you are currently in a relatively low income tax bracket and are more interested in tax-free distributions later than tax deferral now.

Example of pretax savings

If you contribute $115.38 weekly (i.e., $6,000 a year) to your retirement plan, you will only forgo $86.53 in spendable dollars if your tax rate is 25%. This will potentially save you $28.85 in federal income taxes with each paycheck.

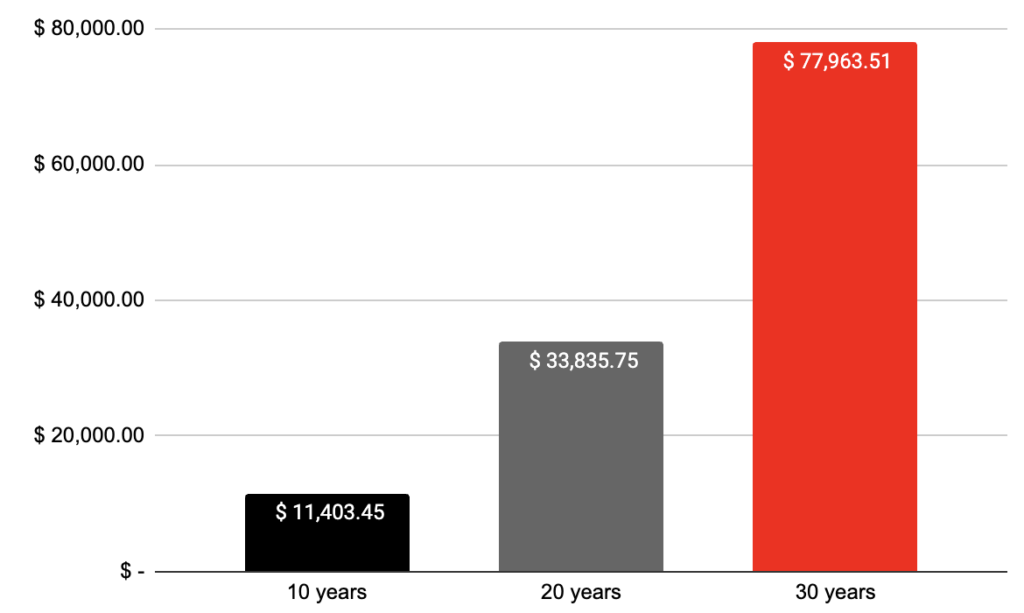

Consider increasing your contribution by 2% each year

Increasing your current contribution can make a big difference in the ability to grow your account over the long term. And, because your contributions benefit from tax-deferred compounding potential, they have the opportunity to grow faster than they would in an account that taxes earnings every year. The example on the right shows how a 2% increase can potentially turn into substantial retirement savings over 10, 20 and 30 years.

How 2% can turn into substantial retirement savings

Here’s a hypothetical example of how an extra 2% contribution each year can grow over time. Remember, every dollar you contribute to the plan benefits from tax-deferred compounding. In addition, if you have an existing account balance, contribute more than 2% or your plan has a company matching contribution, your results could be greater.

What’s an ideal contribution rate?

How much you contribute to your retirement plan each month will depend on several factors, including your salary, financial obligations and number of years until you plan to retire. Your financial professional can also assist you with determining an appropriate retirement savings goal and contribution rate.

2% retirement plan contribution — $800 annually

Assumptions: 2% annual pretax retirement plan contribution made for time periods indicated. Salary used for example is $40,000 and assumed growth rate is 7% annually. Please keep in mind that rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk. This example does not take into account the effect of investment management fees, product-related fees or taxes. Source: mycalculators.com, 401(k) Calculator.

Take action: Your retirement plan offers the flexibility to change your contributions (check with your employer for specific rules). If you have questions about your plan or want to change your contributions, contact your benefits office or financial professional.

On June 9, 2023, the IRS issued guidance on the taxation of fixed-indemnity health insurance policies that provide payments to participating employees when they complete a health-related activity that is available at no cost or is covered by other insurance. These programs are often marketed as “no-cost wellness programs” that promote “tax free” reimbursements with the potential to provide significant payroll tax savings to employees and the employer. This guidance reinforces the IRS’ earlier concern about the tax treatment of these arrangements.

The guidance concludes that the employer must treat payments to employees under the fixed-indemnity policy as taxable wages.

Details About the Fixed-Indemnity Policy

According to the guidance, the employer, through this arrangement, maintains:

- a group health insurance policy that offers comprehensive health benefits, including preventive care (such as flu vaccinations) without cost-sharing, and

- a fixed-indemnity health insurance policy.

Employees may enroll in one or both options, or neither option. The fixed-indemnity policy has the following terms and conditions:

- Each participating employee makes a monthly pre-tax contribution of $1,200 through the employer’s section 125 cafeteria plan to pay for the employee’s coverage under the fixed-indemnity policy.

- The employer forwards the entire $1,200 contribution to the insurance carrier to pay the premium for the fixed-indemnity policy on the employee’s behalf. The employer is not liable for any additional premium payments under the policy.

- In return for the premium payment, the insurance carrier provides the following benefits to the employee under the fixed-indemnity policy:

a. A benefit for each day that the employee is hospitalized.

b. Wellness counseling, nutrition counseling, and telehealth benefits at no additional cost.

c. Payment of $1,000 (limited to one payment per month) if the employee participates in certain health or wellness activities. The employee’s use of preventive care (such as vaccinations), which are available without cost-sharing under the employer’s comprehensive group health insurance policy, would qualify the employee for the payment, as would the free wellness counseling, nutrition counseling, and telehealth benefits that are available under the fixed-indemnity policy. The employee would be responsible for paying the cost of any other health or wellness activity that is intended to qualify the employee for the $1,000 payment. - When an employee qualifies for the $1,000 payment under the fixed-indemnity policy, the insurance carrier pays the money to the employer, which then pays the money to the employee via its payroll system.

Taxation of Payments Under the Fixed-Indemnity Policy

The IRS concludes in its guidance that the employer must treat the $1,000 payments to participating employees under the fixed-indemnity policy as taxable wages, because the payments are remuneration for employment under benefit plans funded by the employer through its section 125 cafeteria plan and exceed the amount of the actual expenses for medical care. Therefore, under Code sections 104 and 105, and accompanying regulations, the employer is required to report the payments as taxable income to the employees on IRS Form W-2, and to withhold income taxes and FICA taxes on the payments. The

employer is also required to pay its share of FICA taxes, as well as FUTA taxes, on the payments.

Employer Action

Employers that may have implemented a fixed-indemnity program that provides “tax free” wellness benefits should carefully review the program in light of the recent IRS guidance and should work with their tax professionals to comply with the employer’s tax reporting and collection responsibilities under this new guidance.

The IRS released the inflation adjustments for health savings accounts (“HSAs”) and their accompanying high deductible health plans (“HDHPs”) effective for calendar year 2024, and the maximum amount that may be made available for excepted benefit health reimbursement arrangements (“HRAs”). All limits increased from the 2023 amounts.

Annual Contribution Limitation

For calendar year 2024, the limitation on deductions for an individual with self-only coverage under a high deductible health plan is $4,150; the limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300.

High Deductible Health Plan

For calendar year 2024, a “high deductible health plan” is defined as a health plan with an annual deductible that is not less than $1,600 for self-only coverage or $3,200 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $8,050 for self-only coverage or $16,100 for family coverage.

Non-calendar year plans: In cases where the HDHP renewal date is after the beginning of the calendar year (i.e., a fiscal year HDHP), any required changes to the annual deductible or out-of-pocket maximum may be implemented as of the next renewal date. See IRS Notice 2004-50, 2004-33 I.R.B. 196, Q/A-86 (Aug.16, 2004).

Catch-Up Contribution

Individuals who are age 55 or older and covered by a qualified high deductible health plan may make additional catch-up contributions each year until they enroll in Medicare. The additional contribution, as outlined by the statute, is $1,000 for 2009 and thereafter.

Excepted Benefit HRA Adjustment

For plan years beginning in 2024, the maximum amount for an excepted benefit HRA that may be made newly available for the plan year is $2,100.