Every year, the Internal Revenue Service announces the contribution limits for retirement plans, including 401(k), 403(b) and 457(b) plans. As you review your finances, it is important to consider your retirement plan contributions, too.

Contribution limits for 2022

In 2022, the total amount you may contribute as a salary deferral is the lesser of 100% of compensation or $20,500. If you are age 50 or older, you may be able to make an additional catch-up contribution of up to $6,500. (403(b) and 457(b) plans may offer additional catch-up contributions.) Check with your employer for specifics. All limits are subject to change in future years.

Save taxes now or later?

What if your retirement plan offers a choice of pretax and Roth contributions? If you decide to make pretax and Roth contributions to your retirement, then the annual limit above applies to the combined total. Below are other considerations when choosing between these types of contribution:

• Pretax contributions can help you save taxes now

With pretax contributions, your take-home pay is reduced by less than your total contribution and you benefit from an immediate tax reduction.

• Roth contributions can help you save taxes later

With Roth contributions, your take-home pay is reduced by your contribution amount since these are made with after-tax dollars. However, withdrawals of earnings on Roth contributions are not subject to income taxes if you are at least age 59 1⁄2 and have held the account for 5 years or more. Additional rules may apply. Roth contributions could be valuable if you expect your tax rate to be the same or higher at retirement than it is now, you want your beneficiaries to receive tax-free distributions, or you are currently in a relatively low income tax bracket and are more interested in tax-free distributions later than tax deferral now.

Example of pretax savings

If you contribute $115.38 weekly (i.e., $6,000 a year) to your retirement plan, you will only forgo $86.53 in spendable dollars if your tax rate is 25%. This will potentially save you $28.85 in federal income taxes with each paycheck.

Consider increasing your contribution by 2% each year

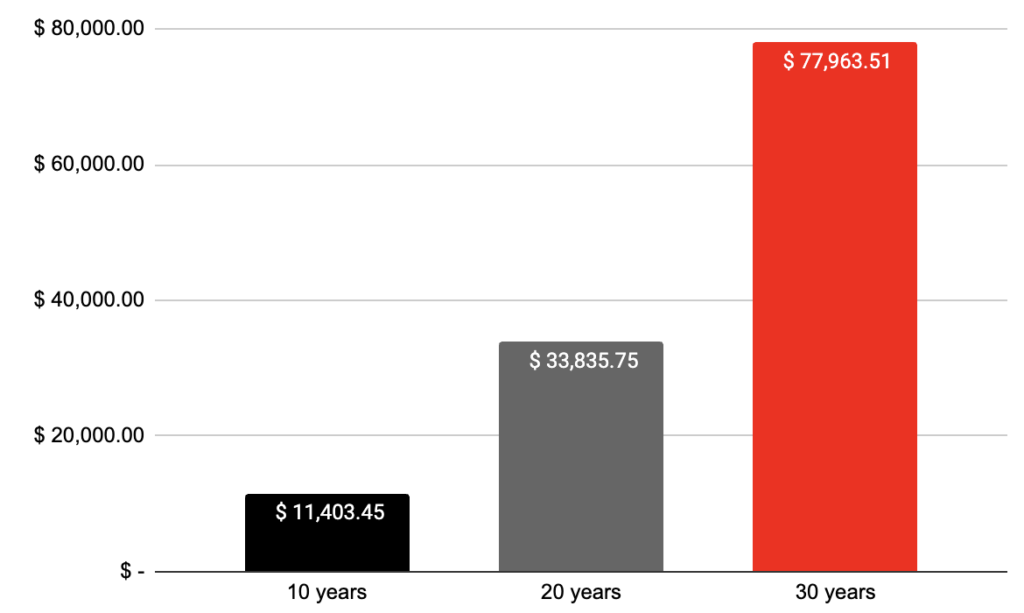

Increasing your current contribution can make a big difference in the ability to grow your account over the long term. And, because your contributions benefit from tax-deferred compounding potential, they have the opportunity to grow faster than they would in an account that taxes earnings every year. The example on the right shows how a 2% increase can potentially turn into substantial retirement savings over 10, 20 and 30 years.

How 2% can turn into substantial retirement savings

Here’s a hypothetical example of how an extra 2% contribution each year can grow over time. Remember, every dollar you contribute to the plan benefits from tax-deferred compounding. In addition, if you have an existing account balance, contribute more than 2% or your plan has a company matching contribution, your results could be greater.

What’s an ideal contribution rate?

How much you contribute to your retirement plan each month will depend on several factors, including your salary, financial obligations and number of years until you plan to retire. Your financial professional can also assist you with determining an appropriate retirement savings goal and contribution rate.

2% retirement plan contribution — $800 annually

Assumptions: 2% annual pretax retirement plan contribution made for time periods indicated. Salary used for example is $40,000 and assumed growth rate is 7% annually. Please keep in mind that rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk. This example does not take into account the effect of investment management fees, product-related fees or taxes. Source: mycalculators.com, 401(k) Calculator.

Take action: Your retirement plan offers the flexibility to change your contributions (check with your employer for specific rules). If you have questions about your plan or want to change your contributions, contact your benefits office or financial professional.

In addition to pretax contributions, your plan also accepts Roth contributions. You can make either or both types of contributions to the plan.

After-tax contributions, tax-free distributions

When you make Roth contributions, you pay federal and, if applicable, state and local income taxes on the contributions when they are deducted from your paycheck. Distributions from your Roth plan account are tax-free, provided certain requirements are met as explained below.

Important note

For more information about Roth contributions, please contact your financial professional. Remember your retirement savings strategy is unique — you should consider consulting your tax advisor to discuss how both types of contributions would apply to your personal financial situation.

Tax-free earnings potential

Distributions of any investment earnings on your Roth 401(k), 403(b) or 457(b) contributions are also tax-free if the distribution occurs when you are age 59½ or older (or upon your death or disability) and is made 5 or more years after the year in which you made your first Roth contribution. Distributions meeting these requirements are referred to as qualified distributions.

You might have to pay federal and, if applicable, state and local income taxes on any investment earnings distributed from your Roth account. A 10% federal tax penalty may also apply (exceptions are available for distributions made for a first-time home purchase up to $10,000, hardship distributions and health insurance premiums.)

Other important facts about Roth 401(k) contributions:

Your combined pretax and Roth contribution limit cannot exceed $22,500 ($30,000 for employees age 50 and older) in 2023.

Eligible Roth 401(k) distributions may be rolled over to any 401(k), 403(b) or governmental employee 457(b) plan that accepts Roth rollover contributions, or to a Roth IRA.

You may change your future contribution elections between pretax and Roth as defined by the plan’s rules

No RMD is required if the account is rolled over to a Roth IRA before RMD payments must start.

A comparison of 401(k), 403(b), 457(b) pretax and Roth contributions

Feature

Pretax contributions

Roth contributions

Employee

contributions

Pretax dollars

After-tax dollars

Investment earnings on employee contributions

Potentially tax-deferred growth

Taxable when withdrawn unless a qualified distribution (both 5 years of participation in Roth account and at least age 59½,

at death or disabled)

Distribution prior to

age 59½

Ordinary federal and state income taxes, plus a 10% federal tax penalty on the

entire balance

Ordinary federal and state income taxes, plus a 10% federal tax penalty on earnings only

Tax treatment of

distributions after

age 59½

- Ordinary income tax will apply to all amounts distributed (contributions and earnings)

- State income tax and withholding may

also apply

- Contributions and earnings: tax-free if distribution

occurs no earlier than 5 years following the initial

Roth contribution - Ordinary income tax will apply only to earnings

if a 5-year participation period and one of the

three applicable Roth-qualifying events

are not met (age 59½, death or disability) - State income tax and withholding may also apply

Eligible distributions

can be rolled over

Yes

Yes

Contribution limits

$22,500 in combination of both sources, or $30,000 if age 50 or older during the plan year

$22,500 in combination of both sources, or $30,000

if age 50 or older during the plan year

Required minimum

distributions (RMDs)

Later of age 72 or separated from employment with sponsoring employer if not 5% owner

- Later of age 72 or terminated from employment with sponsoring employer if not 5% owner

- Ability to roll over qualified distribution to Roth IRA where no RMD requirement applies if rollover occurs before RMD is required under the plan

On June 9, 2023, the IRS issued guidance on the taxation of fixed-indemnity health insurance policies that provide payments to participating employees when they complete a health-related activity that is available at no cost or is covered by other insurance. These programs are often marketed as “no-cost wellness programs” that promote “tax free” reimbursements with the potential to provide significant payroll tax savings to employees and the employer. This guidance reinforces the IRS’ earlier concern about the tax treatment of these arrangements.

The guidance concludes that the employer must treat payments to employees under the fixed-indemnity policy as taxable wages.

Details About the Fixed-Indemnity Policy

According to the guidance, the employer, through this arrangement, maintains:

- a group health insurance policy that offers comprehensive health benefits, including preventive care (such as flu vaccinations) without cost-sharing, and

- a fixed-indemnity health insurance policy.

Employees may enroll in one or both options, or neither option. The fixed-indemnity policy has the following terms and conditions:

- Each participating employee makes a monthly pre-tax contribution of $1,200 through the employer’s section 125 cafeteria plan to pay for the employee’s coverage under the fixed-indemnity policy.

- The employer forwards the entire $1,200 contribution to the insurance carrier to pay the premium for the fixed-indemnity policy on the employee’s behalf. The employer is not liable for any additional premium payments under the policy.

- In return for the premium payment, the insurance carrier provides the following benefits to the employee under the fixed-indemnity policy:

a. A benefit for each day that the employee is hospitalized.

b. Wellness counseling, nutrition counseling, and telehealth benefits at no additional cost.

c. Payment of $1,000 (limited to one payment per month) if the employee participates in certain health or wellness activities. The employee’s use of preventive care (such as vaccinations), which are available without cost-sharing under the employer’s comprehensive group health insurance policy, would qualify the employee for the payment, as would the free wellness counseling, nutrition counseling, and telehealth benefits that are available under the fixed-indemnity policy. The employee would be responsible for paying the cost of any other health or wellness activity that is intended to qualify the employee for the $1,000 payment. - When an employee qualifies for the $1,000 payment under the fixed-indemnity policy, the insurance carrier pays the money to the employer, which then pays the money to the employee via its payroll system.

Taxation of Payments Under the Fixed-Indemnity Policy

The IRS concludes in its guidance that the employer must treat the $1,000 payments to participating employees under the fixed-indemnity policy as taxable wages, because the payments are remuneration for employment under benefit plans funded by the employer through its section 125 cafeteria plan and exceed the amount of the actual expenses for medical care. Therefore, under Code sections 104 and 105, and accompanying regulations, the employer is required to report the payments as taxable income to the employees on IRS Form W-2, and to withhold income taxes and FICA taxes on the payments. The

employer is also required to pay its share of FICA taxes, as well as FUTA taxes, on the payments.

Employer Action

Employers that may have implemented a fixed-indemnity program that provides “tax free” wellness benefits should carefully review the program in light of the recent IRS guidance and should work with their tax professionals to comply with the employer’s tax reporting and collection responsibilities under this new guidance.

What are your employees’ retirement income goals?

Offering a retirement plan for your employees is an important step in helping them become retirement-ready. At Benefits Square, we believe through effective education, we can guide your employees through each stage of their career — whether they’re just starting out, juggling the demands of mid-life, transitioning to their next act or defining their legacy. From informative educational articles, interactive calculators and ongoing seminars, your employees will have a suite of materials tailored to their common retirement questions.

83% of workers expect their workplace retirement savings will be a source of income in retirement vs. about half of retirees.

Financial wellness begins with a retirement plan

Your employees will have access to personalized wellness and educational topics, covering a full breadth of lifestyle stages, as well as online digital tools, giving them a clear picture of what means the most to them and discovering a path to the future they’ve envisioned.

Quick questions, quick answers

Whether it is selecting one of the frequently asked questions or visiting a breadth of topics in the content library, the site is designed to give your employees a choice, allowing them to customize their experience.

Library of learning

There is a host of content in a variety of formats: videos, calculators, tutorials and educational articles to help your employees learn about financial topics that are most important to them in a digestible manner.

Your dedicated retirement plan consultant (RPC)

To help you achieve retirement plan success, we have a team of dedicated knowledgeable professionals who can assist you with:

- Fiduciary education

- Educating employees about retirement plan basics

- Increasing participation and deferral rates

- Local point of contact

From the initial enrollment meeting to future ongoing enrollment meetings and seminars, your RPC is available to assist. In addition, our employee education program features a series of educational emails easily delivered to your employees.

To take advantage, it’s as simple as providing us with employee email addresses.

We take care of the rest.

Ongoing employee education

To keep your employees well-informed, we offer a series of educational seminars, articles and emails no matter what stage of their career.

We have a series of seminars featuring the following topics:

- Preparing for retirement

- Asset allocation- Understanding market volatility

Our emails provide education on the benefits of saving for retirement, asset allocation and the power of compounding over time.

- Increasing contributions

- Preparing for a comfortable retirement (enrollment)

- Managing your account online

- Retirement myths and realities

- Understanding your investments

- Financial fundamentals

Each seminar features real-life examples in easy-to-understand language. In addition, we provide an attendance sheet and seminar evaluation form.

For more information about how Benefits Square can help your

employees with retirement education, contact us at

(732) 902-0200 or click here to request a call.

The IRS released the inflation adjustments for health savings accounts (“HSAs”) and their accompanying high deductible health plans (“HDHPs”) effective for calendar year 2024, and the maximum amount that may be made available for excepted benefit health reimbursement arrangements (“HRAs”). All limits increased from the 2023 amounts.

Annual Contribution Limitation

For calendar year 2024, the limitation on deductions for an individual with self-only coverage under a high deductible health plan is $4,150; the limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300.

High Deductible Health Plan

For calendar year 2024, a “high deductible health plan” is defined as a health plan with an annual deductible that is not less than $1,600 for self-only coverage or $3,200 for family coverage, and the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $8,050 for self-only coverage or $16,100 for family coverage.

Non-calendar year plans: In cases where the HDHP renewal date is after the beginning of the calendar year (i.e., a fiscal year HDHP), any required changes to the annual deductible or out-of-pocket maximum may be implemented as of the next renewal date. See IRS Notice 2004-50, 2004-33 I.R.B. 196, Q/A-86 (Aug.16, 2004).

Catch-Up Contribution

Individuals who are age 55 or older and covered by a qualified high deductible health plan may make additional catch-up contributions each year until they enroll in Medicare. The additional contribution, as outlined by the statute, is $1,000 for 2009 and thereafter.

Excepted Benefit HRA Adjustment

For plan years beginning in 2024, the maximum amount for an excepted benefit HRA that may be made newly available for the plan year is $2,100.

The key to an effective ancillary benefit strategy is filling core health insurance gaps by understanding and matching the needs and demographics of a particular client with available benefit options.

A Little Perspective…

As healthcare costs in the post-pandemic environment continue to rise and employers are facing the difficult challenges of hiring and retaining talent in a candidate-driven market, benefit specialists are looking for creative ways to enhance their company’s employee benefit package. Intuitively, many consultants have built solutions around ancillary benefit programs, which have gained significant traction over the years. Despite the abundance of ancillary benefit programs, many fail to achieve the desired levels of employee appreciation and utilization due to poor planning, improper design, and lack of effective communication. With a shift in current employee needs and focus, offering a simple life and disability program no longer placates the general employee population. Understanding today’s diverse range of employee demographics and education levels in combination with the widespread demand for technology-based solutions are keys to achieving beneficial results. Employers should seek to satisfy the diversity of medical and service needs today’s employee requires. To be truly effective, the benefit professional needs to design a client’s ancillary program around each employer’s specific workforce, taking into account their dynamic, evolving healthcare needs, service interests, and willingness to use products that might be innovative and lesser known.

Employee availability to ancillary benefits has been historically linked to employer size, industry type, and geographic locale. In recent years, however, these benefits have gained importance as a differentiator among employers, requiring even the smallest of companies to package the right mix of ancillary coverages in order to successfully achieve their business goals. Our Ancillary Benefits Team can work with you to craft solutions to help employers and their employees achieve successful long-term health outcomes.

The Pivotal Role of Ancillary Programs In an Evolving Benefits Landscape

In an environment where companies are finding it a challenge to attract and retain necessary top-tier talent, the employee benefit package offered to workers takes on a level of heightened importance. And while the health insurance portion of a company benefit program is often put in a primary position, it isn’t the only benefit desired by employees. Ancillary benefits can play a pivotal role in making a workplace more attractive for both new applicants and existing employees.

What Are Ancillary Benefits?

Ancillary programs are typically secondary benefits that are offered in conjunction with a core medical insurance product. These supplemental benefits are provided as a way to enhance the overall value of a company’s employee benefit package, providing additional support for the total well-being of both employees and their families. Employers can provide these ancillary benefits to their workforce in one of two formats:

Voluntary benefits: where the employee pays 100% of the cost, but is taking advantage of lower premiums and sometimes better coverage levels than might be available outside the group plan. The lack of company premium contribution makes this approach an easy one for the employer.

Employer-contributory benefits: where the employer will typically pay either a significant portion of the premium or the entire cost of the benefit.

Why Should a Business Offer Ancillary Benefits?

The strength of an employer’s overall package of employee benefits will usually provide a significant advantage in the company’s ability to acquire and maintain a competitive workforce. Additionally, a strong ancillary benefits program shows that the employer truly cares about their employees, resulting in improved morale among the employee population. The added emphasis on employee well-being can boost the future prospects of a business, since employees who feel valued and appreciated by ownership are likely to be motivated to be more engaged in the business and contribute to the company’s success in a meaningful way. Benefits to the business can include lower rates of employee turnover, increased worker productivity, lower rates of absenteeism, and greater overall profitability. Since a solid benefit package consisting of well-chosen ancillary coverage contributes to the efforts of employees and their dependents to remain healthy, employers will often find added rewards through lower claim utilization, resulting in positive impacts on health plan renewal premiums.

Crafting a Results-Oriented Strategy

In order to ensure that an ancillary benefits program achieves maximum effectiveness as a results-oriented strategy, care must be taken when crafting the structure and details of the program. Blindly piecing together a few benefits without a coherent, well-designed plan is not only a waste of employer dollars but also a failed opportunity to put the finishing touches on a successful total rewards benefit package

1. Target Employee Needs

A comprehensive analysis of workforce demographics (including age, income levels, family status, and geographic characteristics) coupled with an understanding of specific company-wide employee needs is a promising first step in the development of an effective ancillary strategy. Employee questionnaires and surveys are a helpful tool to utilize. Then, by targeting the specific and anticipated needs of a particular population, an ancillary benefit portfolio can be crafted, producing a high degree of employee satisfaction.

2. Address Coverage Gaps

By plugging the holes in any employee-perceived coverage gaps, the employer can more effectively round out a sound benefit portfolio, allowing employees to further enhance their well-being and reduce their personal financial exposure at minimal cost. This can be more readily accomplished once a worker demographic and needs analysis (as described in step 1) is performed.

3. Integrate with the Core Benefit Offering

For optimum results, the ancillary benefit program should be integrated as much as possible into the core employer-paid benefit package. Too often, ancillary benefits are relegated to a lower tier when communicating benefits instead of being highlighted as an essential part of the overall offering. By treating these benefits with greater significance, employees are more apt to understand the true value of the ancillary offering, and will be more likely to enroll in programs that they perceive will enhance their family’s overall health financial lifestyle.

4. Choose Products That Offer True Value

Just because a product may fill an employee need doesn’t automatically mean there’s a place for it in an ancillary benefit offering. Employees will be unfazed by and unlikely to enroll in coverages that don’t provide a true value to them through some savings or enhancement. If they can obtain the same coverage for the same cost on their own, outside the employer sponsored program, the ancillary product provides little or no value and will likely fail to meet enrollment goals.

5. Find the Right Vendors

Numerous vendors provide benefits in the ancillary marketplace, but performing due diligence through the selection process and finding the best vendor for each company can mean the difference between the program’s success and failure. In addition to the vendor’s financial soundness, portfolio of benefits offered, benefit parameters and costs, it is important to verify any geographic applicability, technology utilization, and ongoing employee service structure. One of the hallmarks of a successful vendor choice is one that leaves company benefit personnel with little or no administrative work.

Flexibility and Scope of Ancillary Benefits

In the following sections we’ll take a look at the scope of benefit options available through an ancillary program based on these areas of need.

With an increasingly diversified workforce, ancillary benefits have become a way to address a variety of employee needs, offering them freedom to choose those programs that enhance their personal health and wellbeing and provide security for themselves and their families. The value ancillary products bring any employee benefit program is significant,as the degree of flexibility and customization available presents tremendous opportunities.Additionally, the value they bring in terms of being able to accommodate the varied needs of workers has become a differentiator for many employers. In addition to the more traditional products offered, such as life and disability, there are also hospital indemnity, accident coverage, dental, and vision programs among others. Today’s employers have recognized their employees concerns for education and financial well-being by offering educational training and access, student loan and debt repayment programs, personal financial planning, pre-paid legal, and identity theft protection.The plethora of programs currently available from vendors can be categorized according to the areas of need they fill, such as:

Protection of

Health – assisting the employee and any covered dependents to achieve a higher level of well-being and means to offset costs related to illness and injury

Lifestyle and Wealth – minimizing health risks or reducing risk of financial loss due to health issues

Protection for Security and Personal Interests – providing protection for dependents and survivors and against identity theft

ANCILLARY BENEFITS DESIGNED FOR:

Protection of Health

Dental Insurance

Coverage for dental expenses can include both routine (regular dental appointments, cleanings, scalings and polishing of teeth) and major dental procedures like extractions, caps, crowns, dentures, etc. As with most things health-related, treating issues that may crop up early is instrumental in preventing more costly treatment later on. And in turn, this keeps future costs down for the employee as well as the employer. Good dental hygiene can be an indicator of overall health resulting in lower claim utilization on the company health plan.

Vision Insurance

Coverage for eye exams can lead to early detection of more serious disease, such as glaucoma, high blood pressure, and diabetes. Additionally, these plans may provide coverage through allowances or discounted fees for frames and lenses, contacts, and laser eye surgery. The ability to obtain coverage for eye exams through ancillary insurance products is attractive to both employees and job seekers.

Accident Insurance

Expenses build quickly when an accident occurs and this type of policy provides benefits that individuals can apply toward these costs. The benefits for this type of insurance are typically paid based on a specified injury, such as a broken leg or fractured wrist, and could be used for things like transportation or lodging costs.

Cancer Insurance

When a cancer diagnosis is received, the last thing people want to add to their worry list is the impact the illness will have on their financial health. Most carriers,as a result, provide a specified sum payment that can range from $10,000 to $100,000, paid upon the diagnosis of specified types of cancer.

Hospital Indemnity Insurance

This coverage provides a cash benefit when the beneficiary is hospital confined. This coverage is designed to help with any out-of-pocket costs related to the stay. This can help with the cost of deductibles, coinsurance, outpatient surgery, doctor’s office visits, emergency room visits, etc.

Critical Care Insurance

Serious health events typically come with serious expenses for the patient. These programs often pay benefits based on the diagnosis of a specified critical illness. Most carriers will list among their covered illnesses diagnoses like cancer, heart attack, stroke, kidney failure, blindness, paralysis, and major organ transplants. The designated flat dollar payments are made to the insured regardless of any other coverage the individual may have. The rationale for these plans is treatment and care has significant financial liability from unreimbursed expenses, both medical (like deductibles and coinsurance) and non-medical (like travel, child-care, etc.) resulting from such illnesses.

ANCILLARY BENEFITS DESIGNED FOR

Protection of Wealth and Lifestyle

Disability Insurance

After good medical insurance, income replacement (or more commonly disability coverage) is the most important insurance for most people to have. Both short term and long-term disability products can be utilized for protection against loss of income.

Pre-paid Legal

Many people neglect to solicit proper legal advice when necessary for real estate, vehicle, or civil matters and fail to tend to personal matters such as wills, because of legal fees. Providing legal services through ancillary insurance via discounted fee arrangements gives them an option to provide these resources at a lower price point.

Protection for Your Family’s Future

Life Insurance

This coverage is common as a core benefit for many groups, as it provides financial protection for the employee’s family in the event of their death.

Personal Interest Protection

These “soft” benefits are designed to assist individuals with personal, lifestyle needs, and can include discounts, concierge services, and umbrella insurance to provide liability protection above auto or homeowners insurance.