Every year, the Internal Revenue Service announces the contribution limits for retirement plans, including 401(k), 403(b) and 457(b) plans. As you review your finances, it is important to consider your retirement plan contributions, too.

Contribution limits for 2022

In 2022, the total amount you may contribute as a salary deferral is the lesser of 100% of compensation or $20,500. If you are age 50 or older, you may be able to make an additional catch-up contribution of up to $6,500. (403(b) and 457(b) plans may offer additional catch-up contributions.) Check with your employer for specifics. All limits are subject to change in future years.

Save taxes now or later?

What if your retirement plan offers a choice of pretax and Roth contributions? If you decide to make pretax and Roth contributions to your retirement, then the annual limit above applies to the combined total. Below are other considerations when choosing between these types of contribution:

• Pretax contributions can help you save taxes now

With pretax contributions, your take-home pay is reduced by less than your total contribution and you benefit from an immediate tax reduction.

• Roth contributions can help you save taxes later

With Roth contributions, your take-home pay is reduced by your contribution amount since these are made with after-tax dollars. However, withdrawals of earnings on Roth contributions are not subject to income taxes if you are at least age 59 1⁄2 and have held the account for 5 years or more. Additional rules may apply. Roth contributions could be valuable if you expect your tax rate to be the same or higher at retirement than it is now, you want your beneficiaries to receive tax-free distributions, or you are currently in a relatively low income tax bracket and are more interested in tax-free distributions later than tax deferral now.

Example of pretax savings

If you contribute $115.38 weekly (i.e., $6,000 a year) to your retirement plan, you will only forgo $86.53 in spendable dollars if your tax rate is 25%. This will potentially save you $28.85 in federal income taxes with each paycheck.

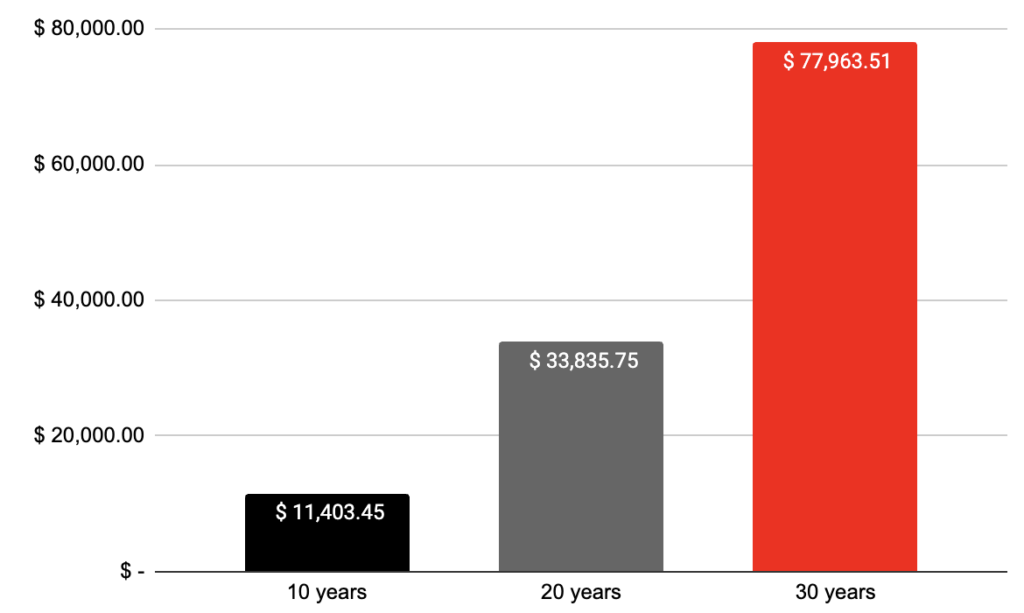

Consider increasing your contribution by 2% each year

Increasing your current contribution can make a big difference in the ability to grow your account over the long term. And, because your contributions benefit from tax-deferred compounding potential, they have the opportunity to grow faster than they would in an account that taxes earnings every year. The example on the right shows how a 2% increase can potentially turn into substantial retirement savings over 10, 20 and 30 years.

How 2% can turn into substantial retirement savings

Here’s a hypothetical example of how an extra 2% contribution each year can grow over time. Remember, every dollar you contribute to the plan benefits from tax-deferred compounding. In addition, if you have an existing account balance, contribute more than 2% or your plan has a company matching contribution, your results could be greater.

What’s an ideal contribution rate?

How much you contribute to your retirement plan each month will depend on several factors, including your salary, financial obligations and number of years until you plan to retire. Your financial professional can also assist you with determining an appropriate retirement savings goal and contribution rate.

2% retirement plan contribution — $800 annually

Assumptions: 2% annual pretax retirement plan contribution made for time periods indicated. Salary used for example is $40,000 and assumed growth rate is 7% annually. Please keep in mind that rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk. This example does not take into account the effect of investment management fees, product-related fees or taxes. Source: mycalculators.com, 401(k) Calculator.

Take action: Your retirement plan offers the flexibility to change your contributions (check with your employer for specific rules). If you have questions about your plan or want to change your contributions, contact your benefits office or financial professional.

In addition to pretax contributions, your plan also accepts Roth contributions. You can make either or both types of contributions to the plan.

After-tax contributions, tax-free distributions

When you make Roth contributions, you pay federal and, if applicable, state and local income taxes on the contributions when they are deducted from your paycheck. Distributions from your Roth plan account are tax-free, provided certain requirements are met as explained below.

Important note

For more information about Roth contributions, please contact your financial professional. Remember your retirement savings strategy is unique — you should consider consulting your tax advisor to discuss how both types of contributions would apply to your personal financial situation.

Tax-free earnings potential

Distributions of any investment earnings on your Roth 401(k), 403(b) or 457(b) contributions are also tax-free if the distribution occurs when you are age 59½ or older (or upon your death or disability) and is made 5 or more years after the year in which you made your first Roth contribution. Distributions meeting these requirements are referred to as qualified distributions.

You might have to pay federal and, if applicable, state and local income taxes on any investment earnings distributed from your Roth account. A 10% federal tax penalty may also apply (exceptions are available for distributions made for a first-time home purchase up to $10,000, hardship distributions and health insurance premiums.)

Other important facts about Roth 401(k) contributions:

Your combined pretax and Roth contribution limit cannot exceed $22,500 ($30,000 for employees age 50 and older) in 2023.

Eligible Roth 401(k) distributions may be rolled over to any 401(k), 403(b) or governmental employee 457(b) plan that accepts Roth rollover contributions, or to a Roth IRA.

You may change your future contribution elections between pretax and Roth as defined by the plan’s rules

No RMD is required if the account is rolled over to a Roth IRA before RMD payments must start.

A comparison of 401(k), 403(b), 457(b) pretax and Roth contributions

Feature

Pretax contributions

Roth contributions

Employee

contributions

Pretax dollars

After-tax dollars

Investment earnings on employee contributions

Potentially tax-deferred growth

Taxable when withdrawn unless a qualified distribution (both 5 years of participation in Roth account and at least age 59½,

at death or disabled)

Distribution prior to

age 59½

Ordinary federal and state income taxes, plus a 10% federal tax penalty on the

entire balance

Ordinary federal and state income taxes, plus a 10% federal tax penalty on earnings only

Tax treatment of

distributions after

age 59½

- Ordinary income tax will apply to all amounts distributed (contributions and earnings)

- State income tax and withholding may

also apply

- Contributions and earnings: tax-free if distribution

occurs no earlier than 5 years following the initial

Roth contribution - Ordinary income tax will apply only to earnings

if a 5-year participation period and one of the

three applicable Roth-qualifying events

are not met (age 59½, death or disability) - State income tax and withholding may also apply

Eligible distributions

can be rolled over

Yes

Yes

Contribution limits

$22,500 in combination of both sources, or $30,000 if age 50 or older during the plan year

$22,500 in combination of both sources, or $30,000

if age 50 or older during the plan year

Required minimum

distributions (RMDs)

Later of age 72 or separated from employment with sponsoring employer if not 5% owner

- Later of age 72 or terminated from employment with sponsoring employer if not 5% owner

- Ability to roll over qualified distribution to Roth IRA where no RMD requirement applies if rollover occurs before RMD is required under the plan

What are your employees’ retirement income goals?

Offering a retirement plan for your employees is an important step in helping them become retirement-ready. At Benefits Square, we believe through effective education, we can guide your employees through each stage of their career — whether they’re just starting out, juggling the demands of mid-life, transitioning to their next act or defining their legacy. From informative educational articles, interactive calculators and ongoing seminars, your employees will have a suite of materials tailored to their common retirement questions.

83% of workers expect their workplace retirement savings will be a source of income in retirement vs. about half of retirees.

Financial wellness begins with a retirement plan

Your employees will have access to personalized wellness and educational topics, covering a full breadth of lifestyle stages, as well as online digital tools, giving them a clear picture of what means the most to them and discovering a path to the future they’ve envisioned.

Quick questions, quick answers

Whether it is selecting one of the frequently asked questions or visiting a breadth of topics in the content library, the site is designed to give your employees a choice, allowing them to customize their experience.

Library of learning

There is a host of content in a variety of formats: videos, calculators, tutorials and educational articles to help your employees learn about financial topics that are most important to them in a digestible manner.

Your dedicated retirement plan consultant (RPC)

To help you achieve retirement plan success, we have a team of dedicated knowledgeable professionals who can assist you with:

- Fiduciary education

- Educating employees about retirement plan basics

- Increasing participation and deferral rates

- Local point of contact

From the initial enrollment meeting to future ongoing enrollment meetings and seminars, your RPC is available to assist. In addition, our employee education program features a series of educational emails easily delivered to your employees.

To take advantage, it’s as simple as providing us with employee email addresses.

We take care of the rest.

Ongoing employee education

To keep your employees well-informed, we offer a series of educational seminars, articles and emails no matter what stage of their career.

We have a series of seminars featuring the following topics:

- Preparing for retirement

- Asset allocation- Understanding market volatility

Our emails provide education on the benefits of saving for retirement, asset allocation and the power of compounding over time.

- Increasing contributions

- Preparing for a comfortable retirement (enrollment)

- Managing your account online

- Retirement myths and realities

- Understanding your investments

- Financial fundamentals

Each seminar features real-life examples in easy-to-understand language. In addition, we provide an attendance sheet and seminar evaluation form.

For more information about how Benefits Square can help your

employees with retirement education, contact us at

(732) 902-0200 or click here to request a call.